1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and exclusively incurred during that period by that person in the production of gross income from that source. Section 331 of the Income Tax Act 1967 ITA reads as follows.

How The Tcja Tax Law Affects Your Personal Finances

3 Chapter 3 provides for tax reductions for married couples and civil partners F1 where a party to the marriage or civil partnership is born before 6 April 1935.

. Section 331 provides that for the purposes of determining tax a persons or business gross income shall be adjusted by deducting from that source all outgoings and expenses wholly and exclusively incurred in the production of gross income 1. In the united states every working person who earns more than a certain amount of money each year needs to pay income taxes to the federal government. Sub Section 1 of Section 195 of the Act provides that any person responsible for paying to a non-resident any sum chargeable to tax under the provisions of the Act shall at the time of credit of such income to the account of the payee or at the time of the payment thereof in cash or by the issue of a cheque or draft or any other mode whichever is earlier deduct.

Non-business income 4 C. Classes of income on which tax is chargeable 4 A. 1 Subject to this Act the adjusted income of a person from a source.

3 Appointment of Comptroller and other officers 3A Assignment of function or power to public body 4 Powers of Comptroller 5 Approved pension or provident fund or society 6 Official secrecy 7 Rules 8 Service and signature of notices etc. Long Title Part 1 PRELIMINARY. According to the Income Tax Department more than 55 crore ITRs were filed by July 31 8 pm.

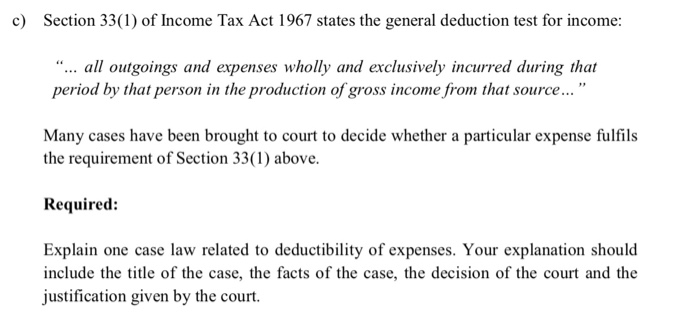

In short when you spend money to earn money youre allowed to deduct that cost from the income. Section 331 of Income Tax Act 1967 states the general deduction test for income. All outgoings and expenses wholly and exclusively incurred during that period by that person in the production of gross income from that source Many cases have been brought to court to decide whether a particular expense fulfils the requirement of Section 331 above.

In short when you spend money to earn money youre allowed to deduct that cost from the income. Paragraph 331 a of the Income Tax Act 1967 ITA. 33 Overview of Part.

Section 331 provides that for the purposes of determining tax a persons or business gross income shall be adjusted by deducting from that source all outgoings and expenses wholly and exclusively incurred in the production of gross income1. Income Tax Act 1947. However the allowable expenses under subsection 331 of the ITA.

And iii computation of allowable interest expense according to source of income chargeable under paragraphs 4a 4c 4d or 4f of the ITA. Ii restriction on the amount of interest expense deductible against gross business income under subsection 332 of the ITA. This Ruling also applies to gains or profits.

Read if you have missed the ITR filing AY 2022-23. This provision empowers the Comptroller of Inland Revenue to disregard vary or make such adjustments he deems appro. The central government already implied that the deadline would not be extended for filing income tax this year.

This is the amount you pay to the state government based on the income you make as opposed to federal income tax that goes to the federal government. A Guide to Income Tax Deductions Author. 1 3 a In respect of a new ship or new machinery or plant other than office appliances or road transport vehicles which is owned by the assessee and is wholly used for the purposes of the business carried on by him there shall in accordance with and subject to the provisions of this section and of section 34 be allowed a deduction in respect of the previous year in which the.

OF THE TAX 3. Charge of income tax 3 A. 1 Short title 2 Interpretation.

Non-chargeability to tax in respect of offshore business activity 3 C. Free for one month and pay only if you like it. Whether the DGIRs imposition of penalties on the taxpayer for the YAs 2006 to 2009 and.

In short when you spend money to earn money youre allowed to deduct that cost from the income. Learn more about the new tax changes when you. Special classes of income on which tax is chargeable 4 B.

1 3 a In respect of a new ship or new machinery or plant other than office appliances or road transport vehicles which is owned by the assessee and is wholly used for the purposes of the business carried. In section 33 of the Income-tax Act for sub-section 3 the following sub-section shall be substituted namely 3 Where in a scheme of amalgamation the amalgamating company sells or otherwise transfers to the amalgamated company any ship machinery or plant in respect of which development rebate has been allowed to the amalgamating company under sub. Section 331 provides that for the purposes of determining tax a persons or business gross income shall be adjusted by deducting from that source all outgoings and expenses wholly and exclusively incurred in the production of gross income 1.

Nur Mafuzia Mat Jusoh Yusoff Keywords. Gains or profits from a business arising from stock in trade parted with by any element of compulsion 5. 1 This Part provides for personal reliefs.

Section 33 and You. Under Section 331 of the Income Tax Act 1967 the ITA instead of allowing the taxpayer to deduct the quit rent payments in full under Section 331 of the ITA for the years of assessment YAs 2006 to 2009 and 2011. The Public Ruling includes that under subsection 331 of the Income Tax Act 1967 ITA an outgoing or an expense which is wholly and exclusively incurred in the production of gross income from a source by a person is generally allowable as a deduction against gross income from that source.

This is the new general anti-avoidance provision. The income tax return filing deadline for the Assessment year 2022-23 and Financial year 2021-22 ended on July 31. Section 33 in The Income- Tax Act 1995.

Section 331 provides that for the purposes of determining tax a persons or business gross income shall be adjusted by deducting from that source all outgoings and expenses wholly and exclusively incurred in the production of gross income 1. 2 Chapter 2 provides for entitlement to a personal allowance and a blind persons allowance. TAX AVOIDANCE AND SECTION 33 OF THE INCOME TAX ACT This article discusses section 33 of the Income Tax Act introduced by the Income Thx Amendment Act 1988 repealing the old section.

In short when you spend money to earn money youre allowed to deduct that cost from the income.

Best Proprietorship Registration At Kolkata Income Tax Return Income Tax Return Filing Income Tax

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Standard Deduction Tax Exemption And Deduction Taxact Blog

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Income Tax Refund When There Is A Mismatch Between Actual Payable Tax And The Tax Amount Paid Then The Itr Refund Pro Tax Refund Income Tax Income Tax Return

Willing To Get Associated With A Performer

How Federal Income Tax Rates Work Full Report Tax Policy Center

1099 Nec Software To Create Print And E File Irs Form 1099 Nec

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Additional Evidence Before Commissioner Of Income Tax Appeals Income Tax Income Tax

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Solved C Section 33 1 Of Income Tax Act 1967 States The Chegg Com

Modified Scheme Of Tax Collection For Salaried Employees Cbdt Sag Infotech Tax Deducted At Source Budgeting Tax